Start-Pay-YouTube

Technical Support Consultant

Schemes Services Affidavit mpigr sampda 2.0

!शुभ शरुआत स्टार्ट पे के साथ!

INDIA'S IMPORT EXPORT CODE REGISTRATION PORTAL

आयात (Import) का मतलब है, किसी दूसरे देश से सामान मंगाना, और निर्यात (Export) का मतलब है, अपने देश से सामान दूसरे देश में भेजना। शिपमेंट (Shipment) का मतलब है, सामान भेजना या मंगाना, चाहे वो आयात हो या निर्यात

A commercial invoice requires the following information:

- Your official company letterhead

- Sender’s full name and address, including postal code

- Sender’s telephone, fax or mobile number and VAT number

- Receiver’s complete address details for the recipient of the shipment, including telephone, fax or mobile numbers

- Invoice date

- Waybill number

- DHL as the carrier

- Shipper’s invoice number

- Sender’s reference

- Recipient’s reference

- Total quantity for each item

- Country of origin for each item

- Full description of the goods

- Customs commodity code for each item

- Unit weight

- Unit value of each item

- Subtotal of each item

- Net weight for this shipment

- Shipment gross weight

- Total number of shipment pieces

- Total value and currency of the shipment

- Freight and insurance charges

- Other charges

- Currency code

- Total invoice amount

- Type of export (permanent, temporary, repair)

- Terms of sale / terms of trade (Incoterms® 2010 Rules)

- Reason for export

- Additional notes

- Complete declaration with your name, company title

- Signature

- Company stamp (if required)

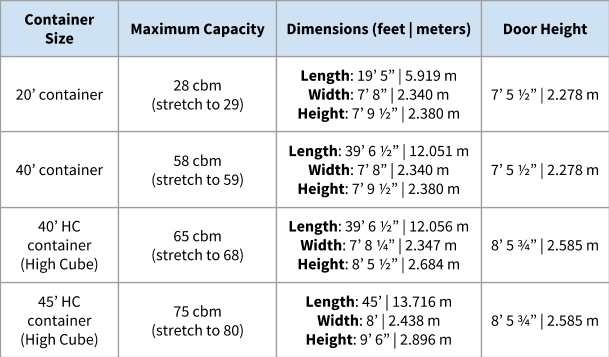

CBM Calculator

Freight Forwarders in India

| Indian Rupee | 85.5 RS | 1$ | United States Dollar | |||

| RS | $ | India | ||||

| 1 | Gross Weight | 6.5 | Net Weight | 6.5 | ||

| 2 | Assessable Value | 8380.83 | Duty(Rs.) | 1508.5494 | ||

| 3 | Invoice Value | 3889.8 | Payment processing fees | 500 | ||

| 4 | State Code | 23 | Freight | 1500 | ||

| 5 | Rate of Exchange USD | 85.5 | Insurance | 120 | ||

| 6 | IGST Duty | 18% | 1508.549 | Duty Advancement Charge | 0 | 996719 |

| 7 | Quantity | 30 | 149.701 | Warehouse Charge | 0 | 996719 |

| 8 | Unit Price $ | 45.49473684 | 3889.8 | Total | 0 | |

| 9 | Airport of Shipment (USD ) | 52.52666667 | 4491.03 | IGST Duty | 270 | |

| 10 | Item subtotal (USD ) | 98.02140351 | Fines | 0 | ||

| 11 | Full payment (USD ) | 98.02140351 | 8380.83 | Total India | 3898.5494 | |

| 12 | Final Price RS/- | 12279.379 | 409.3126 | Single Piece | 800 | |

| 12 | Profit Price RS/- | 24000 | 527.5335 | Profit Share RS/- | 11720.62 | |

What is actual weight?

Actual weight is the most straightforward metric used to measure the weight of a package. It refers to the weight of a parcel as recorded by a scale and is measured in kilograms (kg) or pounds (lbs). Actual weight is crucial for determining shipping costs, especially for dense or compact packages.

What is volumetric weight?

Volumetric weight, also known as dimensional weight, considers the amount of space a package occupies in relation to its weight. Shipping providers use volumetric weight in addition to actual weight to set shipping costs, especially for lightweight but bulky items.

For instance, if you’re shipping a large box filled with bubble wrap, its actual weight might be minimal, but because it takes up considerable room, the cost should reflect that. This approach prevents customers from underpaying for large but lightweight shipments.

volumetric weight? Calc- Length Width Height - Formula

Length Breadth Height Formula

L*B*H / in case of Land 5000 =

L*B*H / in case of Air 6000 =

L*B*H / in case of Sea 1000000=

| Assessable Value | INR | 1000 |

| BCD@15% | 15% | 150 |

| SWS@15% | 1.50% | 2.25 |

| IGST@18% | 18% | 0.405 |

| Total Custom Duty | 35% | 152.655 |

Example: If you have 56 CBM of a substance with a density of 500 kg/m³, the mass would be: 56 * 500 = 28,000 kg.

20 foot container convert 26 CBM (cubic meters) to kilograms (kg)

Calculations:

Air Freight: 26 CBM * 167 kg/CBM = 4342 kg

Sea Freight: 26 CBM * 1000 kg/CBM = 26000 kg

Road Freight: 26 CBM * 333 kg/CBM = 8658 kg

Trade Guide on Exports 84713010

Match IEC GSTIN

GST Rates

Link Aadhaar Status

Promoter/Partner, Authorized Signatory

international trade term (Incoterm)

CHA - Customs House Agent

DDP - Delivered Duty Paid

DDU - Delivered Duty Unpaid

DPU - Delivered at Place Unloaded

DAP - Delivered-at-place

FOB - Free On Board - Buyer Risk

CIF - Cost, Insurance, and Freight - Seller Risk

EXW- Ex Works

FCA - Free Carrier

FAS- Free Alongside Ship

CFR -Cost and Freight

Value Added Services and Surcharges (VASS)

- Export VASS

- Import VASS

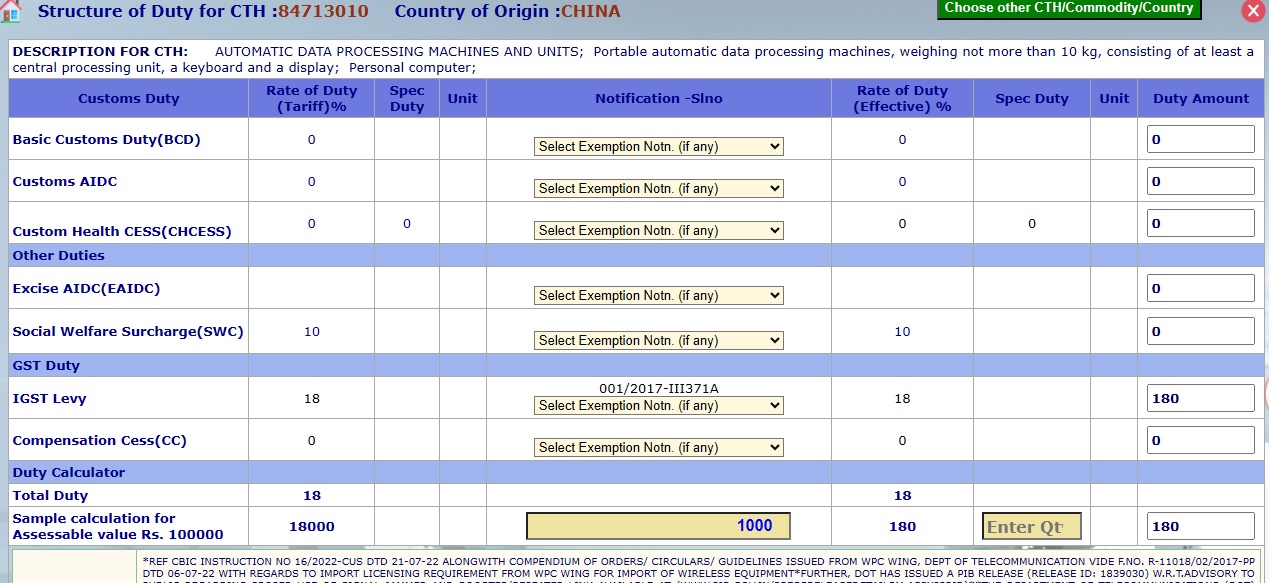

Indian Import Duty Customs Duty 84713010

List of Major & Largest Sea Ports In India

| 1 |

Jawaharlal Nehru Port,

|

जवाहरलाल नेहरू बंदरगाह, नवी मुंबई, महाराष्ट्र |

|

2 |

Mumbai Port, Mumbai, Maharashtra |

मुंबई बंदरगाह, मुंबई, महाराष्ट्र |

|

3 |

Mundra Port, Kutch, Gujarat |

मुंद्रा बंदरगाह, कच्छ, गुजरात |

|

4 |

Marmagao Port, Goa, India |

मर्मागाओ बंदरगाह, गोवा, भारत |

|

5 |

Hazira Port, Hazira, Gujarat |

हजीरा बंदरगाह, हजीरा, गुजरात |

|

6 |

Kandla Port, Kandla, Gujarat |

कांडला बंदरगाह, कांडला, गुजरात |

|

7 |

Visakhapatnam Port, Visakhapatnam, Andhra Pradesh |

विशाखापत्तनम बंदरगाह, विशाखापत्तनम, आंध्र प्रदेश |

|

8 |

V.O Chidambaranar Port, Tuticorin, Tamil Nadu |

वी.ओ चिदंबरनार बंदरगाह, तूतीकोरिन, तमिलनाडु |

|

9 |

Cochin Port, Kochi, Kerala |

कोचीन बंदरगाह, कोच्चि, केरल |

|

10 |

Chennai Port, Chennai, Tamil Nadu |

चेन्नई बंदरगाह, चेन्नई, तमिलनाडु |

Authorized Dealer Code Bank Account Registration Advisory

| INVOICE | TOTAL WEIGHT |

| PACKING LIST | TOTALCBM (CUBIC METER) |

| SHIPPING MARK | TOTAL CARTOON / BOXES |

| LABEL IF REQUIRED | TOTAL INVOICE VALUE |

| PRODUCT LICENCE IF REQUIRED | PRODUCT DETAILS |

Customs Duty

Basic Customs Duty(BCD)

Customs AIDC

Custom Health CESS(CHCESS)

CESS

National Calamity Contingent Duty (NCCD)

Other Duties

Excise AIDC(EAIDC)

Social Welfare Surcharge(SWC)

GST Duty

IGST Levy

Compensation Cess(CC)

Duty Calculator

Total Duty

Sample calculation for Assessable value Rs. 1000

Compulsory compliance Requirements (CCRs)

अनिवार्य अनुपालन आवश्यकताएँ (सीसीआर)

* नए वाहनों का आयात नीति शर्त संख्या 2, 7 और 9 से अध्याय 87 के अधीन होगा। सेकेंड हैंड या इस्तेमाल किए गए वाहनों का आयात नीति शर्त संख्या 1 से अध्याय 87 के अधीन होगा। कस्टमाइज़्ड कारों/मोटरसाइकिलों और भागों का आयात नीति शर्त संख्या 10 से अध्याय 87 के अधीन होगा। लागू छूट के लिए नीति शर्त संख्या 3, 4, 5, 6 और 11 देखें।* निर्माताओं द्वारा या भारत में उनके अधिकृत प्रतिनिधियों के माध्यम से या द्वारा आयात किए गए वाहनों का पंजीकरण संगठन/नागरिक को निजी उपयोग, प्रदर्शन, परीक्षण, अनुसंधान या वैज्ञानिक उपयोग आदि के लिए केंद्रीय मोटर वाहन (ग्यारहवां संशोधन) नियम, 2018 का अनुपालन करना होगा। नीति शर्त 12, जीएसआर 870(ई) दिनांक 13-09-2018, सड़क, परिवहन और राजमार्ग मंत्रालय और डीजीएफटी अधिसूचना संख्या 14/2015-20 दिनांक 28.08.2019 देखें।*

StartPayOnline | Whatsapp Channel – Follow Link

Start-Pay-YouTube

| Schemes Services Affidavit MPIGRS* |  |

| Service Provider's support is for* |  |

| Purposes and knowledge only* |  |

All Application - Online Apply

Hitachi Atm Wla Franchise 2025

| UltraViewer Free Remote Desktop Software |

Public User Service Provider Loginउपयोगकर्ता लॉगिन @MPIGR |

Office , Interactive Video KYC & Non Interactive Video KYC based instrument

शुरू हो जाओ - "एसपीओं-SPO"

Terms & Conditions apply*